-

JPMorgan Asset Management says three underperforming areas of the stock market have untapped upside potential.

-

Those include the semiconductor, rail and parcel and home improvement sectors, according to the company.

-

Strategists said these could be great additions to a portfolio as earnings growth in AI stocks starts to slow.

While investors remain overwhelmed by the enthusiasm for generative AI, there are undervalued areas of the market that could deliver “coil spring”-like gains. According to JPMorgan Asset Management:.

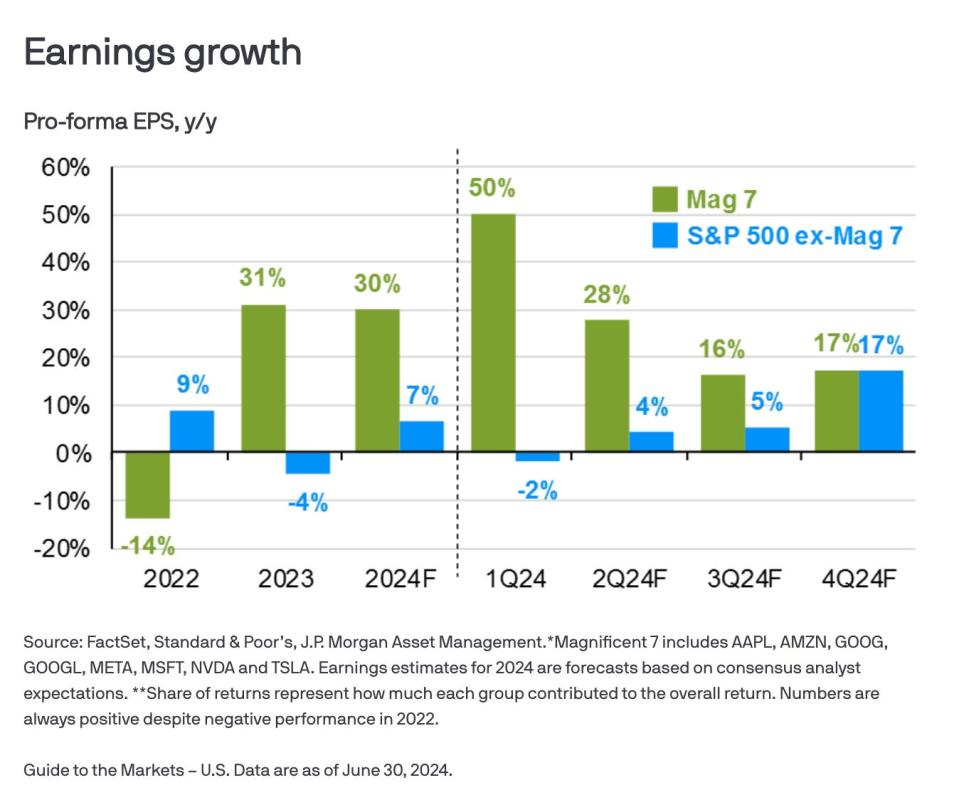

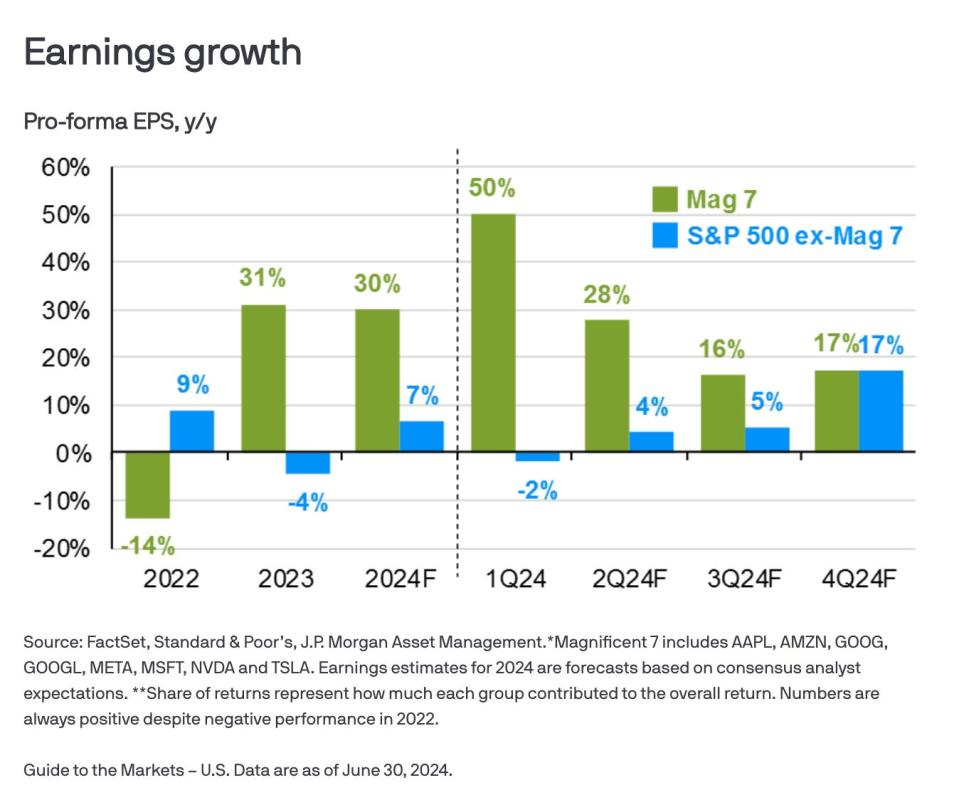

on the other hand, The Magnificent Seven Stocks — This includes tech giants such as NVIDIA, Metaand Microsoft — grew its earnings per share at an annualized rate of 50% in the first quarter, so the rest of the S&P 500 is likely to follow suit.

JPMorgan expects the earnings growth of the other 493 stocks in the S&P 500 index to match that of the Magnificent Seven by the fourth quarter of 2024, as shown in the chart below.

“Looking longer term, large fiscal spending, particularly on infrastructure (e.g., the Control Inflation Act and the CHIPS/Science Act), combined with growing interest in artificial intelligence generation, should provide a accommodative backdrop for stronger secular growth going forward,” the strategists said. “Markets do not appear to have fully priced this outlook, as reflected in the narrow (and narrowing) stock market rally.”

Investors looking for unrealized upside would be well served to look outside of the Mag 7 for stocks with “depressed” valuations that have not yet priced in catch-up earnings growth.

“These names may therefore act like a ‘coiled spring,'” the memo said, highlighting three industries in particular:

semiconductorJPMorgan said there are many opportunities in semiconductors beyond AI deals.

“Slumping sectors such as personal electronics, communications and enterprise may soon recover as demand, which had been sluggish due to the pandemic-induced ‘over-ordering’, picks up steam,” the company wrote.

Rail and parcelThese stocks are expected to rally due to the “unexpected resilience” of the U.S. economy and increased demand for material transportation. Automation in the industry is also expected to increase efficiency, which could also support the rally.

Home ImprovementsAmericans are pausing home improvements, hindered by high interest rates and the fact that many people have already made improvements during the pandemic, but that trend is likely to reverse in the future, strategists say.

“As the average age of U.S. homes increases, the potential for significant maintenance costs increases. Moreover, labor-related delays on older projects are being eliminated as immigration helps address labor shortages,” the researchers said.

JPMorgan’s proposal signals a shift in Wall Street toward recommendations. Diversificationrather than continuing to chase Mag7 profits, this is true amidst a swirl of uncertainty. election The Fed is expected to cut interest rates over the next year. Defensive InvestmentsRelated stocks like energy and utilities have seen big gains over the past year, outperforming even top AI stocks like NVIDIA.

Read the original article Business Insider