Stock NVIDIA (NASDAQ: NVDA) The stock price plummeted after the company’s most recent earnings report and is currently down about 11% from its all-time high.

Nvidia still showed impressive growth, beating analysts’ expectations with quarterly revenue up 122%, but with a market cap of over $3 trillion and expectations sky-high, Nvidia was sold off after the announcement.

One reason is that the company Gross profitHere we explain what happened to this very important metric last quarter and whether investors should be concerned about it.

Why Gross Margins Are the Most Important Thing for NVIDIA and AI Stocks

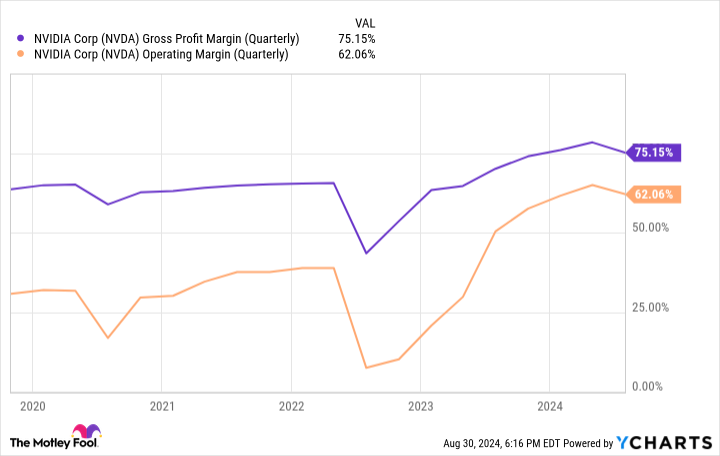

As the AI revolution got underway, cloud computing companies and large enterprises wanted as many of NVIDIA’s data center GPUs as they could. The mismatch between supply and demand allowed NVIDIA to charge a premium price for its chips even as sales volume increased. As a result, the company’s gross margins expanded from a 55% to 65% range before AI to an astounding 78.4% in the first quarter of this year, which ended in April, and its operating margins expanded to 64.9% from a 20% to 40% range in the first quarter.

But as you can see, gross margins and operating margins declined in the recently reported second quarter compared to the first quarter. Gross margin retreated to 75.1%, a decrease of 3.3 percentage points, and operating margins declined to 62.1%. Meanwhile, Analyst CallChief Financial Officer Colette Kress expects gross margins for the current quarter to be just 74.4%.

That could signal slowing demand or a price backlash from big customers who may be weary of paying high prices for Nvidia’s chips. After all, investor concerns about whether cloud customers would be able to recoup all of their AI spending led to a selloff in tech stocks this summer.

However, Nvidia cited a different reason for the decline.

In its announcement, NVIDIA noted that the decline in gross margin was due to “an increased mix of new products in data center and inventory reserves for lower-yielding Blackwell materials.”

This explanation should cause Nvidia shareholders to breathe a sigh of relief, at least for now, as it is understood that Nvidia’s next-generation Blackwell chips are due for a slight delay after a manufacturing defect was discovered during the final stages of production and sampling.

During the conference call, NVIDIA said it had changed the GPU masks at its foundries. Taiwan Semiconductor Manufacturing (NYSE:TSM)to improve manufacturing yields. Notably, this appears to be a minor tweak, as CEO Jensen Huang said it did not require any changes to the chip’s functionality. Still, there appear to have been enough defects in Blackwell’s initial sample run that Nvidia had to scrap a significant number of chips from its initial production run at TSMC.

It’s unclear how much of the decline in gross margin was due to inventory write-downs, but the company said the rest of the decline in margin was due to a “mix shift to new products.”

Will you be able to achieve the same profits with your new product?

In chip manufacturing, it often takes time for yields to ramp up for new products as manufacturing processes are perfected over time, but is Nvidia’s declining gross margin down to lower initial manufacturing yields or is it just becoming increasingly limited in the premium it can charge for new products?

Don’t get me wrong, the current flagship H200 is undoubtedly more expensive than the H100, but the newer product is more complex and therefore more expensive for TSMC to manufacture.

So it’s unclear whether the rest of the gross margin decline is due to lower initial yields that will eventually rise as production volumes increase, or if it’s because Nvidia can’t maintain the same profit margins as it raises prices on new products while new chips get higher and higher list prices.

After all, NVIDIA points out that 45% of its revenue comes from cloud service providers, all of which are increasingly developing their own home-grown AI accelerators to reduce costs. Meta Platform (Nasdaq: META)The company, which is not a cloud service provider but probably accounts for a large chunk of Nvidia’s revenue in addition to its 45% revenue, has also started designing its own accelerators. Advanced Micro Devices (NASDAQ: AMD) This will continue to keep Nvidia on its toes, as the company expects sales of its just-released MI300 series AI GPUs to exceed $4.5 billion this year.

But all of these companies should continue to buy Nvidia’s chips: Nvidia still makes the most advanced neutral third-party GPU chips, and developers are already familiar with CUDA software, so Nvidia’s sales should remain strong for the next few years.

But with competition heating up as major customers seek lower-cost alternatives with their own designs, NVIDIA will have to compete harder than ever before — either by staying ahead in hardware, lowering prices or both.

So Nvidia investors should keep a close eye on gross margins over the next few years, even as revenue rises, or model some margin reversion.

Should I invest $1,000 in Nvidia right now?

Before you buy Nvidia stock, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now… and Nvidia wasn’t among them. The 10 stocks selected have the potential to generate big gains over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That works out to $731,449.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

*Stock Advisor returns as of August 26, 2024

Randi Zuckerberg, former director of market development and public relations for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Billy Duberstein and/or his clients have invested in Meta Platform and Taiwan Semiconductor Manufacturing. The Motley Fool has invested in and recommends Advanced Micro Devices, Meta Platform, NVIDIA, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends: Disclosure Policy.

Should Nvidia investors be worried about declining gross margins? Originally published on The Motley Fool