Matteo Colombo/DigitalVision via Getty Images

RBC Capital Markets said there’s at least one sign that the S&P 500 (SP500) (SPY) could avoid a 5% drop from its recent highs.

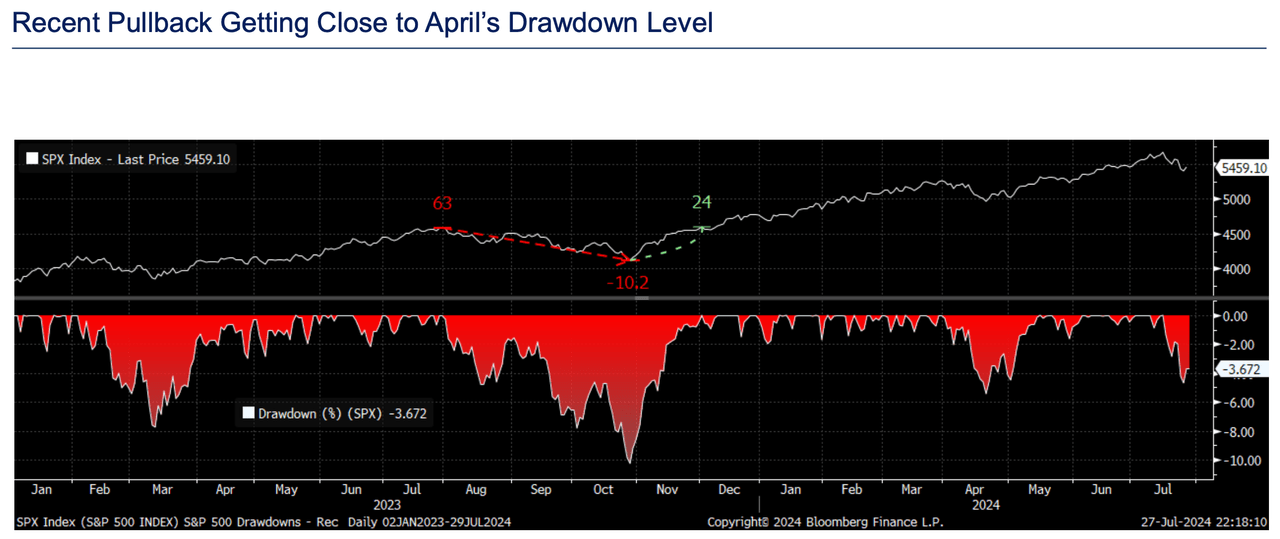

Investors cash out profits in big tech stocks Small hat (RT-Y)(International HydrologyThe S&P 500 and other sectors fell 4.7% from their all-time high on July 16 through Friday’s close. The drop isn’t as bad as the 5% drop during April trading, but it’s “getting close,” Lori Calvasina, head of U.S. equity strategy at RBC, said in a Monday note.SP500)(Vaux)(IVV) ended April down 4.2%.

She said one bright spot for the stock market was the AAII investor sentiment survey released last week, which showed net bullishness had fallen to 11.5% as of July 25, with the four-week average at 21%. Bullish sentiment experienced its biggest one-week drop since February 2023. Last week’s move means the four-week average is no longer more than one standard deviation above the long-term average, she said.

“This is good news for U.S. stocks, as they often fall after reaching a level one standard deviation above their four-week average,” Calvasina said. “We’ll be watching this data closely over the coming weeks to see if optimism reignites or remains subdued,” he said.

Market research firm CFRA separately said Monday that the S&P 500’s 4.7% decline was near the “pullback threshold,” defined as a decline between 5% and 9.9%.

Meanwhile, RBC’s Calvasina said inflows into U.S. stocks remain strong and are “watching for a bottoming out.”Commodity Futures Trading Commission positions in U.S. stock futures are now above previous peaks for the overall stock market and the S&P 500, he said.

Bank of America said on Friday that exchange-traded funds withdrew $29.6 billion in the last week, and also noted outflows of $7.4 billion from mutual funds.

Below is the RBC graph: