Just Dial shares have performed well this year, posting a nearly 60% return year-to-date, driven by steady progress in the last three to four quarters. bl.portfolio In our edition dated February 13, 2022, we had recommended investors with a long-term perspective to buy more into the stock when the stock was trading at around Rs 840. Our positive view at the time was based on a reasonable valuation, room for improvement in operating performance, a strong balance sheet and a track record of consistent cash flow generation.

Moreover, the presence of Reliance Industries (via Reliance Retail Ventures) as the company’s largest shareholder (63.84%) was a positive in terms of potential synergies with Reliance’s long-term e-commerce plans.

Even after the recent rally, many of the positive factors mentioned above remain intact. In fact, the EV/EBITDA (1-year forward) valuation is currently cheaper at around 17x compared to 22x in February 2022. With management’s strong execution, the company’s performance has improved steadily over the past two years and this momentum is expected to continue.

Synergies with Reliance’s e-commerce business have not been as robust, but the potential remains. Moreover, the balance sheet is fairly strong, with net cash on the books at 44% of the current market cap. Somewhat encouraging news on the company’s strong cash position is that management announced in a recent earnings call that it is in internal discussions with the board on plans to distribute at least 100% of annual profits to shareholders (dividends/share buybacks).

If executed, this could be a significant catalyst for the stock price. For perspective, the yield is 3% based on trailing 12 month EPS and closer to 5% based on FY25 EPS projections. While it is unclear when a decision will be made, this is an important aspect to watch as valuation will be weighed on by uncertainty over the company’s plans on how to use the excess cash.

Overall, most of the positive factors remain intact, allowing investors to continue buying on dips. Considering that uncertainties related to global markets may result in some volatility in Indian stocks, especially small caps, we prefer buying in small instalments over a period of time rather than lump sum purchases.

work

Just Dial is India’s largest local search engine, serving 11,000+ postal codes across 250+ cities across the country. With a pan-India presence, Just Dial connects businesses with users across India. It provides localized information about services to Indian users across multiple platforms (Mobile/Desktop/Phone) and has established a strong presence in the Indian digital ecosystem.

Just Dial, which has a long track record in the local search business, has a large database of around 45 million listings, mostly consisting of MSMEs (micro, small and medium enterprises).

The company offers various aspects of its services that benefit SMEs through its core applications JD App (business discovery and reviews), JD Ratings (verified ratings for SMEs/Medium Enterprises), JD Business (management of business listings with value-added features), JD Mart (B2B marketplace) and JD Analytics (insights into customer engagement and value-added services). Some of these are well developed and the company is focused on improving client mining with others.

Currently, the majority of the company’s revenue comes from subscription packages for small businesses, which are prepaid and therefore have no recoupment risk. While free listings are allowed under the subscription packages, small businesses can benefit from features such as priority listings and increased visibility in search.

Recent Performance

Given that the SME/MSME segment forms the fulcrum of the company’s business, its gradual recovery after a few COVID-19 hit years is reflected in the company’s improving financial and operational performance. This, along with improved execution and cost management, are incremental positives driving profitability.

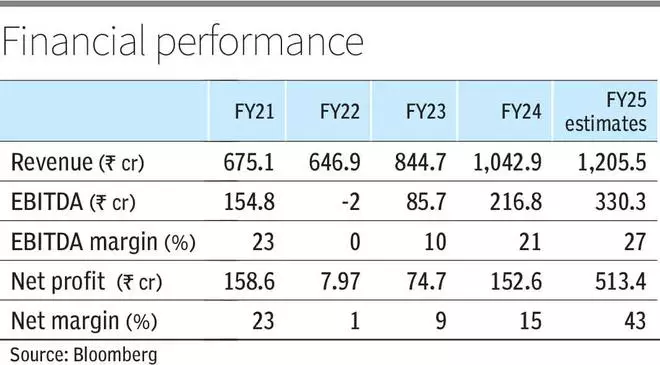

User engagement, including quarterly unique visitors, active listings and ratings/reviews, has improved steadily in recent quarters (see chart).Financial performance has also improved steadily in FY23 and FY24 after a hit in FY22.

In the recently announced June quarter results, revenue was INR 2,860 crore, up 13.6% year-on-year, and EBITDA was INR 860 crore, up 119.8% year-on-year. EBITDA margin was 28.7%, up 13.8% year-on-year, a strong increase. Net profit was INR 1,410 crore, up 60% year-on-year. The latest quarterly results reaffirm a trend of the company’s performance improving steadily quarter-on-quarter.