Vasileios Tsianos, Vice President of Corporate Development, in the summer of 2023 Neo Performance Materialsbegan receiving calls from government officials on both sides of the Atlantic. In the world of industrial materials manufacturing, NEO is best known for producing rare earth magnets used in everything from home appliances to electric vehicles. However, these calls were not about rare earths. They were about something rather rare: gallium metal.

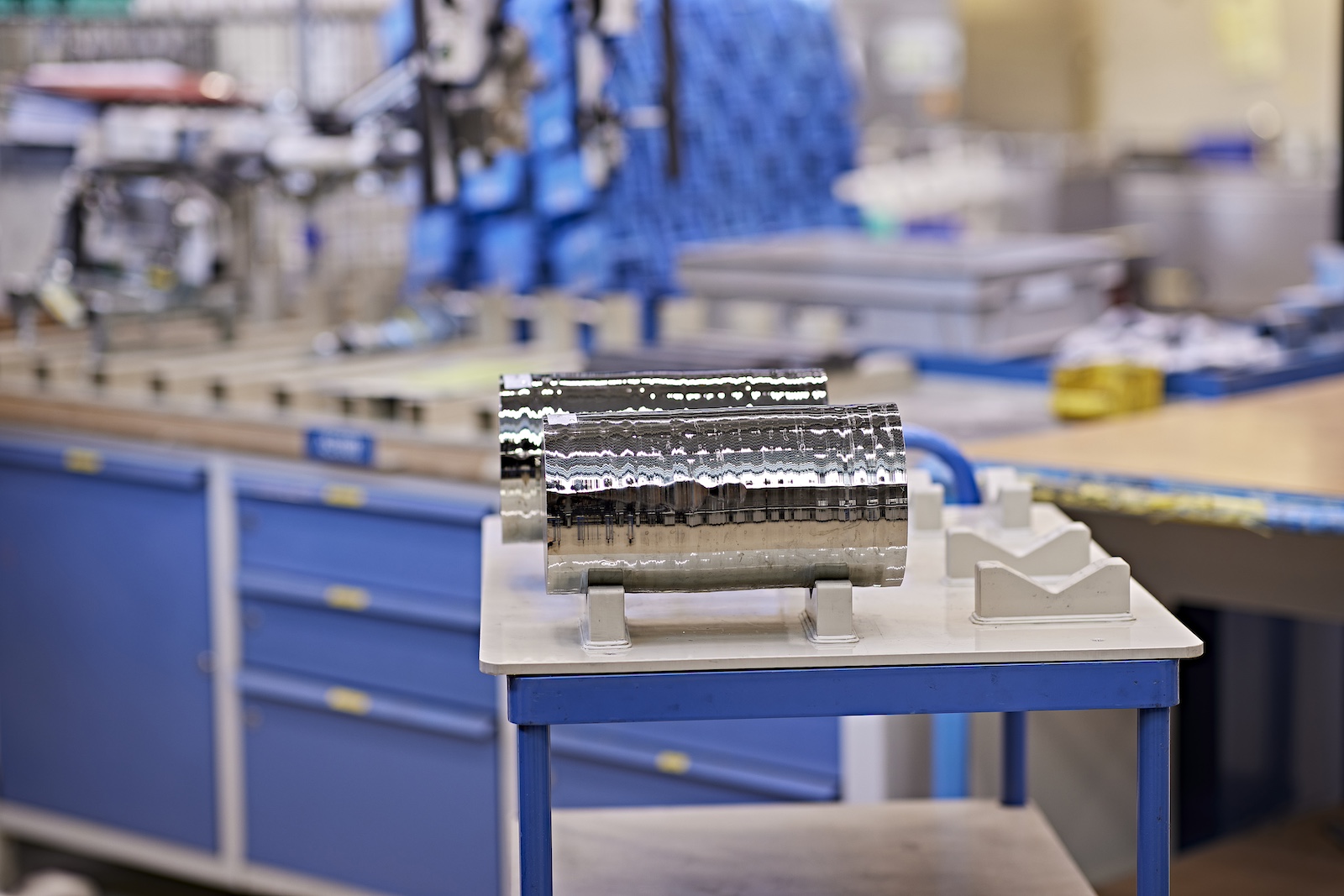

NeoRecycle Dozens of tons A factory in Ontario, Canada, mainly from the production of semiconductor chips for a year. In North America, it is the only industrial-scale producer of metals, and is used not only in chips, but also in clean energy technology and military equipment.

China, one of the world’s leading producers, has spent much longer announcement New export controls for gallium, Apparently accordingly Reports include the US government considering restrictions on the sale of advanced semiconductor chips to China.

Suddenly people wanted to talk to Neo. “We spoke to almost everyone,” Tournos told Grist, his interest in producing gallium outside of China.

Since Tsianos began to receive these calls, the tension surrounding the 31st element of the periodic table, as well as the 32nd germanium used in advanced technology, has also escalated. December, China It was completely prohibited Exporting both metals to the US following the Biden administration’s decision Additionally, limits US chip exports.

Several companies currently operating in the US and Canada are considering expanding their production of rare metals to meet our demand. Canadian critical mineral producers may be swept for a new geopolitical star if Trump passes with him The threat of imposing tariffsUS metal producers could see support from the new administration. The first day of presidential order. Beyond the US and Canada, industry observers say China’s export ban is fueling global interest To make the critical mineral supply chain more diverse, we will ensure that there is no one country with chalkholding more than essential materials for the high-tech clean energy future.

“This latest round of bans has added a lot of wind to the sails of key mineral supply chain efforts, not just in the US but also worldwide.” Seaver One Grist said of the Breakthrough Institute, a research center focused on technical solutions to environmental issues.

Gallium and germanium are not exactly common names. However, they are found in a society that does not contain essential products and fossil-free fuels. Gallium is used due to its impressive electrical properties Semiconductor chip This will take you to everything from cell phones to electric vehicle power converters to LED lighting displays. This metal is also used in rare earth magnet manufacturing for electric vehicles and wind turbines, thin film solar cells, and sometimes commercially popular silicon solar cells, which helps improve performance and extend lifespan.

Barris Sekakin via Getty Images/Anadoll

Germanium, on the other hand, is used to refract light within fiber optic cables. In addition to supporting formation The backbone of the internetthe extraordinary light scattering properties of metals are useful for infrared lenses, semiconductor chips and highly efficient solar cells used by satellites.

There are not many alternatives for these two elements. Some silicon-based semiconductors do not have gallium, and certain infrared technologies can replace special germanium glasses. Solar cells are often doped with boron instead of gallium. However, these two metals often have certain properties that make them ideal materials. As for clean energy, Tsianos told Grist there is no alternative to the “material performance and cost trade-off spectrum” offered by Gallium.

As it comes a little longer, both metal markets are small and dominated by China. In 2022, the world produced approximately 640 tons of low-purity gallium and over 200 tons of germanium. US Geological Survey. In recent years, China accounts for almost all of the world’s low purity gallium production and more than half of sophisticated germanium.

This is partly due to the fact that both metals are by-products of other industries. Gallium is usually extracted from bauxite ore, as it is processed to make aluminum oxide, but zinc miners may squeeze germanium out of waste generated during purification. China is reading producer Of these common metals, the government, according to the King, has made jointly extracted gallium and germanium a priority. “It’s very strategic,” he said.

China’s two metal supply chain control gives considerable embrace in the ongoing trade war with the US. US Geological Survey study The release in November showed that if China implements a total moratorium on exports of both metals, it could cost the US economy billions of dollars. A few weeks after the study was published, China announced the ban.

The ban is so new that it is not yet clear how US companies or the federal government are responding. However, the American high-tech manufacturing sector is not without fallback options. Neo facilities in Ontario, north of the border, are ready to double gallium production. Tsianos. “We have the ability,” he told Grist. “We’re waiting for more ingredients.”

Currently, NEO’s only source of gallium is the semiconductor industry. Chipmakers in Europe, North American and Asian send scraps to the company. This is processed to restore high purity gallium back to semiconductor manufacturing. But Tsianos says Neo is piloting bauxite miners around the world and their technology to create a new source of virgin gallium. He believes that bauxite miners will do the initial treatment on-site and then send low-purity gallium to Neo for further refinement in Canada. Tsianos refused to name the specific bauxite company Neo is affiliated with, but said the company is “making progress” to make new resources available.

Meanwhile, in British Columbia, the mine’s giant Teck Resources is already a major producer of germanium outside of China. Company’s Trail Operation The refinery complex receives zinc ore from a red dog mine in northwestern Alaska and turns it into a variety of products that include it According to estimates from US Geological Surveys, there is about 20 tons of refined germanium per year. (Teck does not disclose production volume.)

The germanium is primarily sold to US customers, Teck spokesman Dale Steeles told Grist. In the wake of the export ban, Steves said the company is currently “exploring options and market support to boost its germanium production capacity.”

Umikoa

Kwasi Ampofo, head of metals and mining at clean energy research firm Bloombergnef, predicted Grist that the US will “try to establish new supply chain ties” with countries that already have important production, such as Canada. He told Grist. , to ensure the necessary gallium and germanium. It may be true whether Trump’s proposed tariffs on Canadian imports will become a reality. Tsianos was bullish despite the tariff threat, but Neo has noted in an email saying that it is “the only industrially and commercially operated gallium facility in North America.”

“[W]E is committed to continuing to serve European, American and Japanese customers in the semiconductor and renewable energy industries,” Tsianos added.

Steves told Grist that the trade war between the US and Canada is “negative to both economies and disrupts the intrinsic critical mineral flows and increased costs and inefficiency on both sides of the border.” he told Grist. Tech “will continue to actively manage sales arrangements to minimize the impact on trail operations,” he said.

Canada may be the US’s shortest-term option for these rare metals, but it is hoped that Ampofour will go further down and that the US will gain “renewed interest” in recycling, particularly military equipment. Masu. 2022, Ministry of Defense announcement We have started a program to recover “optical germanium” from old military equipment. At the time, the initiative was expected to recycle up to three tons of metal each year, or about 10% of the country’s annual demand. The defense subagency responsible for the programme did not respond to a grislist request for comments regarding the programme’s status.

The US has another small capacity global metal company Umicore Recycle germanium Manufactured from scrap, fiber optic cables, solar cells, and infrared optical devices Optical materials facilities in Capo, Oklahoma and Belgium. The company has been recycling germanium since the 1950s, a spokesman called Grist “the core and historical activity of Umicole.” Umicore will not say how much of the metal it recycles and whether China’s export ban will affect this part of its business.

Recycling can meet some of the country’s gallium and germanium needs, but there may be a larger source of both metals lurking in sludge ponds in central Tennessee.

It is the city of Clarksville and is run by Nyrstar, headquartered in the Netherlands. Zinc treatment facility It produces waste containing gallium and germanium. A U.S. Department of Energy spokesman told Grist that the company had previously partnered with Ames National Laboratory’s. Critical Material Innovation Hub To develop a process for extracting gallium, it is not normally produced from zinc waste.

Nyrstar

2023, Nyrstar announcement The plan is to build a new $150 million facility, co-opted with an existing zinc smelter in Clarksville, which can produce 30 tons of germanium and 40 tons of gallium a year. However, the current status of the project is uncertain and there is no timetable to begin construction. A Nyrstar spokesperson told Grist that the company is “continuous.”[ing] Refusing to provide additional details to address and evaluate the business case for the facility.

Creating business cases to produce gallium or germanium is a central challenge for businesses outside of China, experts told Grist. As Neo’s Tsianos said, these metals are “side hustles” that require major upfront investments for relatively small amounts of additional revenue. Furthermore, the ability of bauxite or zinc minors to produce gallium or germanium usually depends on the market conditions of the metals that are primarily focused. That is, “If aluminum is low or zinc is low, mines and smelters may not work, even if the world is screaming for more gallium or germanium.” The king said:

Still, there is an economic incentive to produce these metals than it was a few years ago. Recent geopolitical dramas have caused a “branch” in the prices of gallium, says Tsianos. Outside of China, metal prices have now been “almost doubled” for those within the border.

“There are structural changes in the market that have created business cases outside of China production,” says Tsianos. “And that started out for export control.”