Rural India seems to be becoming increasingly aware of the benefits of insurance coverage. A recent survey on financial inclusion by the National Bank for Agriculture and Rural Development (Nabad) shows a significant improvement in the number of rural households with insurance coverage. While vehicle insurance is popular, crop insurance is also finding many users.

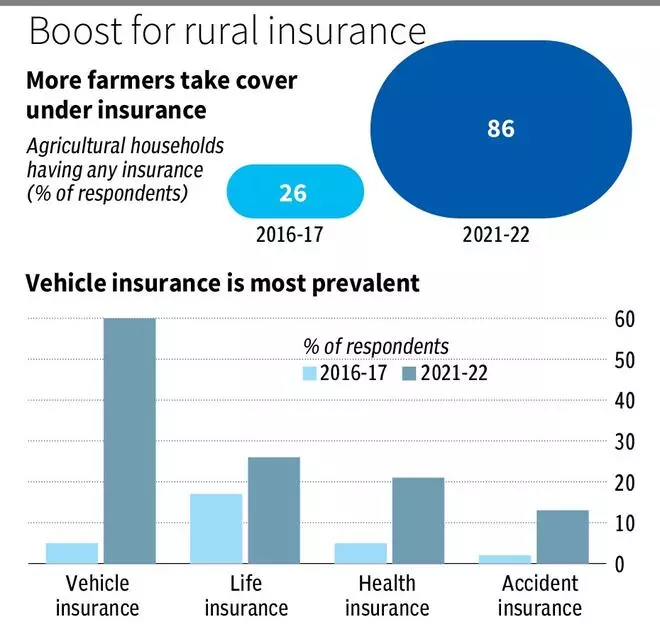

In 2021-22, 86% of agricultural households reported having some form of insurance, a significant increase from 26% in the 2016-17 Nabard survey. Among the types of insurance, vehicle insurance grew the most, increasing from 5% in 2016-17 to 60% in 2021-22. During the same period, health insurance increased from 5 percent to 21 percent, accident insurance from 2 percent to 13 percent, and life insurance from 17 percent to 26 percent.

Maya Kant Awasthi, who teaches food and agribusiness management at IIM Lucknow, said the rise in different types of insurance such as vehicle insurance, health insurance and accident insurance in rural areas is due to the rural population. said that this could be due to increased aspirations, market homogenization, and market homogenization. The gap between urban and rural consumers is narrowing due to increased interaction.

Increased coverage of Fasal Bima

Providing crop insurance across various stages of the crop cycle, PM Fasal Bima Yojana is the largest insurance scheme for farmers. This scheme expands its scope despite being a bit flawed in its implementation.

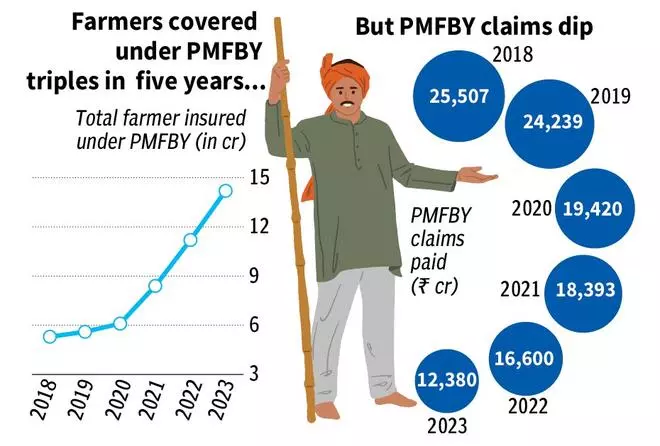

The number of farmers covered by PMFBY has tripled in the past five years. In 2018, 5.3 billion farmer applications were covered under PMFBY, increasing to 8.4 billion in 2020 and further to 14.2 billion in 2023.

According to the data, from 2016 to 2024, around 5.68 crore applications from farmers were received under PMFBY. However, only 41% of the farmers who applied received the amount they applied for. This system covers 30% of the total cultivated area in the country.

The overall amount of claims made under PMFBY has also decreased. Total insurance claims in 2018 were Rs 25,507 billion, which decreased to Rs 18,393 billion in 2021 and further decreased to Rs 12,380 billion in 2023.

“Facilitation of groundwater expansion through tube wells, along with subsidies for tube wells and multiple irrigation sources, reduced the impact of crop loss on final land,” Awasthi pointed out. Having these alternative sources reduces the chance of crop failure, leading to fewer insurance claims. ”

Nabard data also shows that wealthier farmers are more likely to have crop insurance. Among farmers with land of 2.0 hectares or more (large farms), the percentage of respondents who purchased crop insurance increased from 8% in 2016-17 to 23.8% in 2021-22. During the study period, the proportion increased from 10.8% to 21.5% for farms with an area of 1.01 to 2.0 hectares (medium-sized farms), and from 5.1% to 8.8% for farms with an area of 0.41 to 1.0 hectares (small farms) did. period.

Insurance premium management

Elsevier journal, Advances in disaster scienceexplain that wealthy farmers are more likely to adopt crop insurance because they have greater liquidity and easier access to credit, which helps them manage premiums. In contrast, less affluent farmers often face cash flow constraints, which can prevent them from taking up insurance unless they have access to formal credit options such as bank loans.

The Standing Committee’s 2022-23 report highlighted problems with the PMFBY system, pointing to delays in settlement of insurance claims due to delays in releasing yield data and premium subsidies by states. Yield-related disputes between insurance companies and state governments remain a major challenge.

The report said that insurance companies should set up offices in all tehsils as farmers currently face difficulties in insurance-related issues due to lack of local representatives to assist them. I suggest that there is.