Last September, we introduced readers to the concept of ratio graphs. In it, we explained what a ratio chart is, how to create it, and how it can be used as a tool in technical analysis for forecasting.

At the time of conducting this research (September 2023), the Dow Jones Industrial Average was $34,837 and the Nifty 50 index was $19,435. Based on ratio analysis, he said Dow Jones could rise to 39,000 and Nifty to 23,400. Last year, the index not only rose to that level, but surpassed it as well, currently sitting at levels of 42,863 and 24,964.

Similarly, based on the ratio graph, IT, PSU Banks and Pharma were identified as the three sectors that will outperform the Nifty. Nifty has risen 28% since then. Nifty IT, Nifty PSU Bank and Nifty Pharma indices rose 34%, 46% and 57% respectively.

Now is the time to take another look at the ratio chart and see where the market is heading. Here, for the benefit of new readers, we reiterate the basics: what a ratio chart is, what its movements mean, how to interpret it, and how to use it for forecasting.

ratio graph

Take two variables and divide them to calculate a ratio. If we plot this continuously calculated ratio, we get a ratio graph. For example, if you divide the Nifty 50 by the Dow Jones Industrial Average, you get the Nifty50/Dow Jones ratio. If we take the past daily closing prices of both indices and plot the calculated ratio, we get the Nifty50/Dow Jones daily ratio chart. Doing the same by taking the weekly closing prices of both indexes will give you a weekly ratio chart.

chart movement

The movement of a ratio chart can track two scenarios: an uptrend and a downtrend. To illustrate these two scenarios, let’s take the Nifty50/Dow Jones ratio mentioned above.

A ratio graph can go up if:

* Nifty moves up. Dow Jones is down or stable/in range or up but lower than Nifty

* Nifty remains stable/range bound, Dow Jones falls

*Nifty fell, Dow Jones fell more than Nifty.

Ratio graphs can degrade if:

* Nifty waterfall; Dow Jones will rise, stay stable/in range, or fall but below Nifty

* Nifty remains stable/range bound, Dow Jones rises

*Nifty rose, Dow Jones rose more than Nifty.

Interpreting the chart

The rising ratio graph shows that Nifty is outperforming Dow Jones. On the other hand, if the graph is going down, it means the Nifty is underperforming and the Dow Jones is outperforming.

In ratio graphs, the rise and fall of the graph should always be interpreted relative to the numerator, here Nifty.

Also, ratio charts only give you the relative performance of the two parameters used, not the absolute direction of price movement. In other words, even if the ratio graph goes up, the Nifty does not go up. As explained above, even if the Nifty remains stable or range-bound and the Dow Jones declines, the ratio chart can move up.

prediction

Just like any other price chart, you can apply technical analysis to ratio charts to make analysis and predictions. This is one of the great benefits of using ratio graphs. In fact, indicators used in technical analysis such as trend lines and moving averages can also be applied here. This helps predict where the ratio graph is heading. In addition to this, if you have predictions for any two of the ratio variables, you can calculate/predict the third variable.

For example, suppose you are of the view, based on technical analysis, that the Nifty/Dow ratio is likely to rise from its current level to point X. Additionally, if the Dow Jones forecast is Y, multiplying X by Y gives the Nifty forecast.

Restrictions

It is very important to consider the time frame of the forecast here. This means that the ratio and one variable must be predicted for the same time period to successfully predict the third variable. For example, if you expect this ratio to rise to point X within three months, you should make a three-month forecast for the Dow Jones. Otherwise, the logic identifying the third variable, here Nifty, will be wrong. Of course, you can do technical analysis of Nifty directly, but this approach is another way to test your analysis and predictions.

Secondly, if the analysis and predictions made for the Dow Jones and its ratios are wrong, the predictions for the Nifty calculated from the other two will also be wrong.

With these in mind, we will analyze how Nifty can perform in the coming months, where it will go in the future, and what could be the top of Nifty based on the ratio graph.

further rise

Nifty/Dow ratio is currently 0.5824. It is trending down on the chart. The ratio could fall to 0.5740 in the next month or two. In this period, Dow Jones will outperform Nifty. The ratio could then rise to 0.60 by the end of this year. Looking ahead to 2025, the graph of this ratio is likely to increase further towards 0.62 in the first quarter of next year.

Dow Jones looks bullish. The number could rise to 43,000-43,500 in a month or two, and could aim for 44,000-44,500 by the end of the year. The index may then be revised. Therefore, if the stock reverses from $44,000 to $44,500, the Dow Jones Industrial Average could fall to $41,000 in the first quarter of next year.

If we convert this to Nifty, the ratio drops from here to 0.5740, so the range is 25,000 to 25,500. If the Nifty/Dow Jones ratio rises towards 0.60, Nifty could rise to 26,500-27,000. With the ratio rising to 0.62 and the Dow Jones falling to 41,000, there is a potential for a correction down to 25,400.

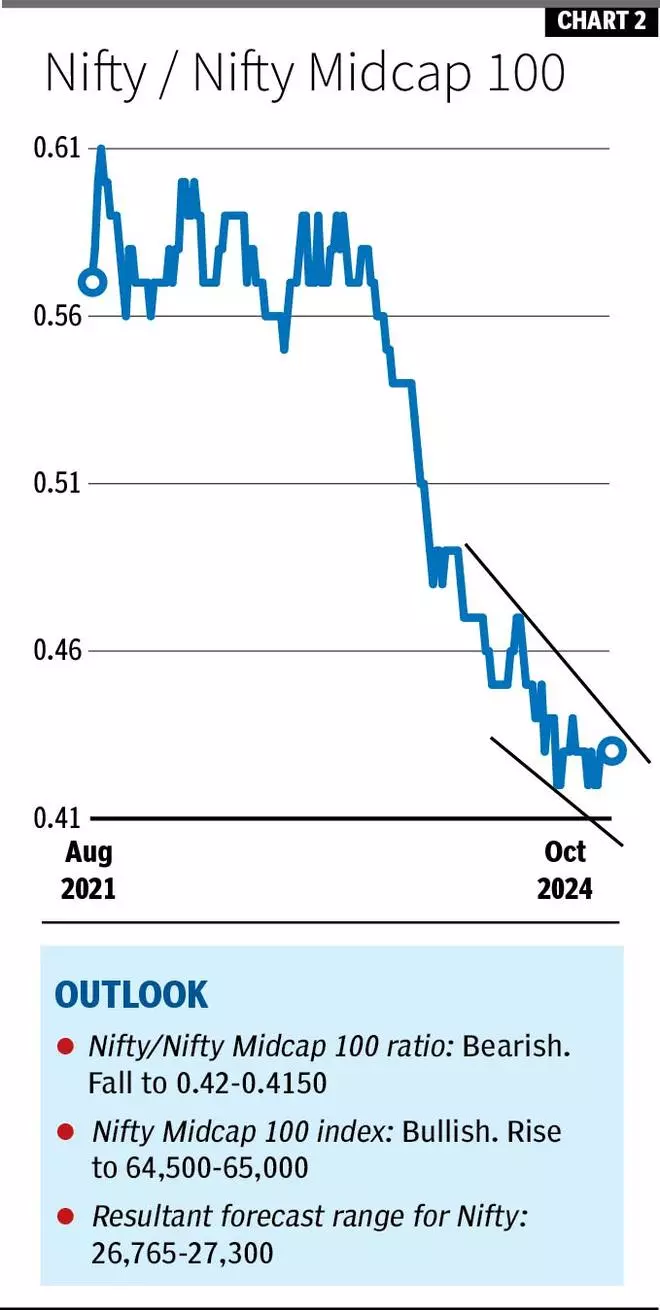

Nifty vs Midcap

The Nifty Midcap100 index (59,213) had strong support at 56,800 and has now rebounded from there. The outlook is bullish. The index could rise to 64,500 or 65,000 by the end of this year.

Nifty/Nifty Midcap 100 ratio is currently 0.43. Bias is negative and falls to 0.42-0.4150.

Therefore, the range of Nifty Midcap 100 is 64,500 to 65,000, the range of Nifty/Nifty Midcap 100 ratio is 0.42 to 0.4150, and the predicted range of Nifty is 26,765 to 27,300. The average is 27,033.

Outlook by sector

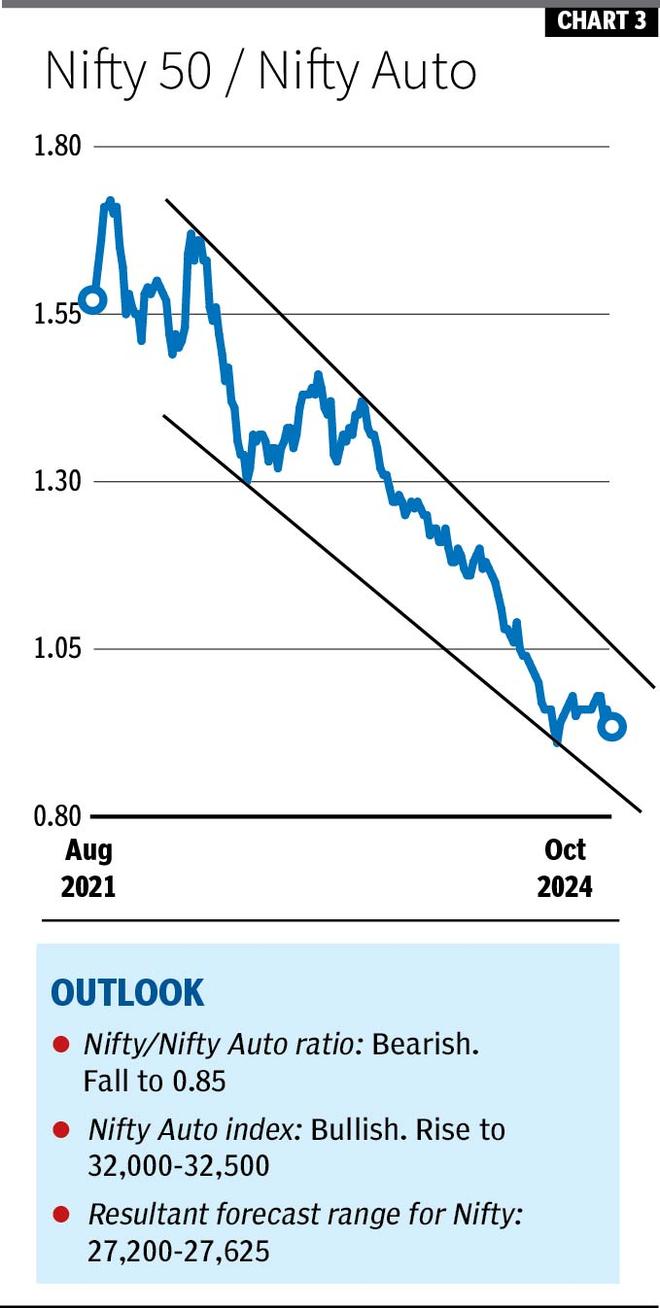

We have identified two sectors that can outperform the Nifty this year. Just like last year, Pharma has found a home this time too. Along with this, we can expect the automobile sector to outperform the Nifty in the future. This is a ratio chart analysis of Nifty Pharma Index and Nifty Auto Index that shows where Nifty is heading.

Nifty/Nifty Auto: The Nifty/Nifty Auto ratio has been on a steep downward trend for nearly three years now. However, it contains interim corrections. The current ratio is 0.94. From here, it could fall to 0.90. Eventually, this ratio could fall below 0.90 and the decline could widen to 0.85.

Nifty Auto index (26,437) is receiving good support at 25,150. The outlook is bullish. The index could rise to 32,000-32,500 in the next three months.

If the index rises to 32,000-32,500 and the ratio falls to 0.85, Nifty could rise to 27,200-27,625 in the meantime.

Nifty/Nifty Pharma: This ratio peaked in May 2023 and has been declining since then. The current ratio is 1.06. From there, it could fall to 1.04-1.02.

We are bullish for the Nifty Pharma index (23,582) to rise to 27,500-28,000 from here. The support level for the index is 22,600.

So, if this ratio falls to 1.02 and Nifty Pharma rises to 27,500-28,000, Nifty could be 26,960-27,450.

remove

All the above ratio chart analysis shows that Nifty has room to advance further from here in the rest of this year. These indicate that Nifty could find a top somewhere in the 27,000-27,500 region by the end of this year. Thereafter, a correctional decline may be expected towards 2025 as indicated by the Nifty/Dow Jones ratio chart analysis.

The above study was limited to only one leg movement in Nifty (increase from 27,000 to 27,500). That’s because other ratio charts, except Nifty/Dow Jones, do not clearly capture movements beyond the one leg predicted above in each section. So, once the Nifty forms a peak and then turns downward, you can revisit the ratio graph to gauge the amount of possible correction.