Enbridge (NYSE: ENB) is not a particularly attractive company, but that’s actually one of the biggest attractions of the stock. It also has a very high dividend yield, at about 7.4%. But to really understand why this stock will be a good buy in a few years’ time, you need to have a deeper understanding of the company’s business and how it will generate value for investors over the long term.

Enbridge is more than just a midstream giant

The energy industry is notoriously volatile, but not all companies in the industry should be labeled with that label. While upstream (drilling) and downstream (refining and chemicals) businesses are often highly volatile, midstream businesses like Enbridge typically are not. That’s because midstream companies own the energy infrastructure (Like a pipeline) and primarily charges fees for the use of its assets.

Enbridge is essentially a toll collector. Oil and natural gas are essential to the smooth functioning of the world, so demand is energy Prices are weak, oil pipelines account for about 50% of EBITDA and natural gas pipelines account for about 25%, which brings us to an interesting fact about Enbridge:

The rest of the energy giant’s business consists of regulated natural gas utilities (22% of EBITDA) and renewable energy investments (3%). Natural gas is cleaner burning than coal and oil and is seen as a transitional fuel. Enbridge recently agreed to acquire three natural gas utilities. Dominion EnergyThis increased Enbridge’s exposure to this energy sector from 12% to over 22%. Regulated utility assets are given monopolies in their service territories in exchange for getting their rates and investment plans approved by the government. This translates into slow and steady growth over time, meaning the investment has made Enbridge’s business more reliable.

Then there’s the renewable energy business, which is pretty small compared to the company’s other businesses. But clean energy is also a relatively small part of the global energy market. Enbridge’s move into this space is essentially an attempt to use its carbon fuel profits to move with the world as clean energy becomes more important over time. This is a hedge of sorts for investors who aren’t ready to jump into renewable energy but are aware of the growing role it is playing in the world.

What can investors expect from Enbridge?

In short, Enbridge is a boring midstream company that’s slowly changing its business in a cleaner direction. That’s not a very exciting story when you factor in its hefty 7.4% dividend yield: Most investors expect the stock market as a whole to return about 10% per year, so Enbridge’s dividend alone would get them about three-quarters of the way there.

Meanwhile, the dividend is backed by an investment-grade balance sheet. And the distributable cash flow payout ratio is right in the middle of management’s target range of 60% to 70%. The dividend has increased annually for 29 consecutive years. This is a reliable dividend stock, and there’s no reason to think the dividend is at risk. In fact, it seems very likely that slow, steady dividend growth in the low single digits is a reasonable expectation.

So if the dividend grows at about 3%, roughly in line with the rate of inflation, the total return an investor can expect would be about 10%, based on the current 7%+ yield plus the roughly 3% dividend growth. Stock prices typically rise over time along with the dividend, keeping the yield constant, so earning market-beating returns from this high-yield stock is not an unrealistic expectation. It’s hard to complain, especially if you reinvest the dividends and get the benefit of compounding over time.

Enbridge’s base case is good

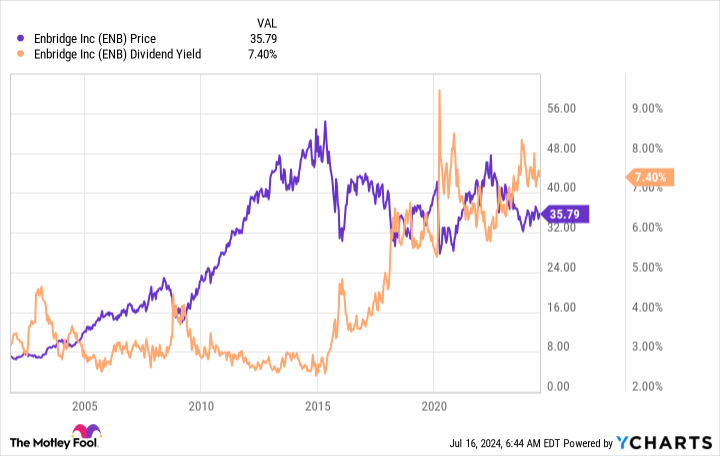

Enbridge can get by on its current track record, which, as mentioned above, would be enough to generate solid profits for investors. But what’s interesting here is that Enbridge’s dividend yield is currently historically high, which actually makes the stock look like it’s underperforming.

It’s entirely possible that this situation will remain the same and that the yield has simply risen to a new range to reflect Enbridge’s current operations. But if Wall Street suddenly becomes interested in the company, investors who bought today would benefit from increased demand for the shares. In our base case, Enbridge’s boring operations generate market-level earnings, but the upside potential could be much greater. This seems like an attractive risk/reward balance, but if you don’t jump in now, you’ll regret missing out.

Should I invest $1,000 in Enbridge right now?

Before you buy Enbridge stock, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now… Enbridge isn’t one of them. These 10 stocks have the potential to generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, $722,626!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

*Stock Advisor returns as of July 15, 2024

Reuben Greg Brewer The Motley Fool has invested in Dominion Energy and Enbridge. The Motley Fool has invested in and recommends Enbridge. The Motley Fool recommends Dominion Energy. The Motley Fool Disclosure Policy.

In a few years, you’ll be glad you bought this cheap, high-yield stock. Originally published on The Motley Fool