President-elect Donald Trump’s calls for higher taxes on imported goods have already sparked debate on Capitol Hill and in corporate boardrooms.

President Trump’s transition team reportedly discussed including the tariffs in a major tax package that Congress plans to tackle next year with Rep. Jason Smith (R-Missouri), chairman of the House Ways and Means Committee. That’s what it means. Some of the 2017 tax cuts are set to expire. politiko report Those discussions have focused on using the tariffs as an offset to other tax cuts that Republicans want to pass, but it’s unclear whether House rules allow for that trade-off.

But at least this is an acknowledgment that tariffs are taxes.

With the federal government running an annual deficit of nearly $2 trillion, finding ways to raise revenue to offset the extension of the 2017 tax cuts is not just smart fiscal policy. It would also probably be needed if Republicans want to pass a major tax bill in the Senate without needing 60 votes. adjustment processwhich allows some issues to avoid the filibuster. considered revenue neutral.

During his campaign, Trump repeatedly promised to use tariffs to offset various tax changes, including his plan to exempt tip income and Social Security transfers from income taxes. He also floated the idea of using tariffs to completely replace income taxes. laughably impossible.

Still, these signs show Congress is taking President Trump’s tariff hikes seriously, and so are U.S. companies. washington post reported Last month, some companies were already preparing for possible price hikes if President Trump wins the election. “We’re going to increase our prices,” Columbia Sportswear CEO Timothy Boyle said. said of post. “We’re buying goods today for delivery next fall. So we just deal with that and we just raise prices.”

meanwhile, new york times reported on Friday Some clothing and footwear retailers say they are rushing to stock up on imported goods before January, when President Trump could use his executive powers to unilaterally impose high tariffs.

Whether passed by Congress or enacted with the stroke of a presidential pen, the end result will be higher tariffs on American consumers. a new report The National Retail Federation, an industry group representing grocers, department stores and online retailers, said this week that President Trump’s proposed tariffs would reduce the purchasing power of U.S. consumers by 46 billion yen per tariff. It is estimated that there will be a decrease of $78 billion from the US dollar.

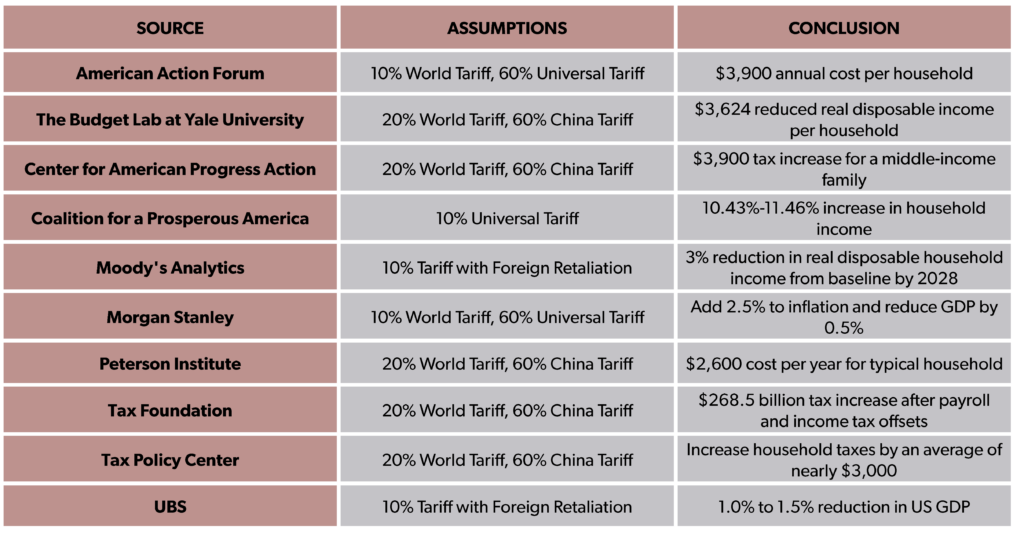

These estimates depend on many variables Of course, we won’t know until the executive order and tariff law are published. However, there is wide agreement among economists that: Higher tariffs will make Americans poorer.—The only question is, how much? Here’s a neat summary of these calculations, compiled by the National Taxpayers Association Foundation:

Procedurally, passing tariffs through Congress gives them more legitimacy than if they were imposed only by the executive branch. It has good and bad sides.

If the tariffs are passed as part of a broader tax bill, their impact could be blunted by extending the cut in personal income tax rates. Americans will still pay higher prices for many goods, but at least they won’t Also You may be subject to a large tax bill from the IRS.

The legislative process may also lessen the impact of tariffs, as lobbyists in affected industries are sure to work hard to create loopholes and carve-outs in the final product.

Of course, this leads to one of the downsides. When certain industries are given special treatment, companies with less influence in Washington are left with relatively high tariff burdens.

Another drawback is the fact that the next president cannot unilaterally cancel tariffs, making it more difficult to reverse tariffs imposed by law (as the Biden administration has demonstrated, of course). (like, that wouldn’t happen anyway).

There’s a lot of moving parts here, but there’s still time for Trump to reconsider this stupid idea, or for his advisers and key figures in Congress to convince him to drop it. One thing we know for sure is that if further tariffs are to be imposed in 2025, consumers will have the least influence over the process and will ultimately bear the lion’s share of the cost. That means it will happen.