Funds from around the world have poured nearly $18 billion into Indian government bonds since JPMorgan Chase announced inclusion in its India bond index for 2023 in September, according to depository institution data.

JPMorgan later announced that it would add Indian government bonds to its Global Emerging Markets Bond Index from June 28, opening up the $1.3 trillion Indian bond market to a wider range of global investors.

The inclusion of Indian government bonds will be phased in over a period of 10 months, starting from June 28th until March 31st, 2025, it was announced.

JPMorgan also said Indian government bonds will be weighted at 1% per month by the end of March 2025, bringing their weighting to 10% in the GBI-EM Global Diversified Index.

RBI Classified Bonds

Only bonds classified under the Fully Accessible Route (FAR) by the Reserve Bank of India are eligible for inclusion in the index. Within this subset of IGBs, there are 27 FAR designated bonds that met the criteria for inclusion in the index as on June 28, 2024.

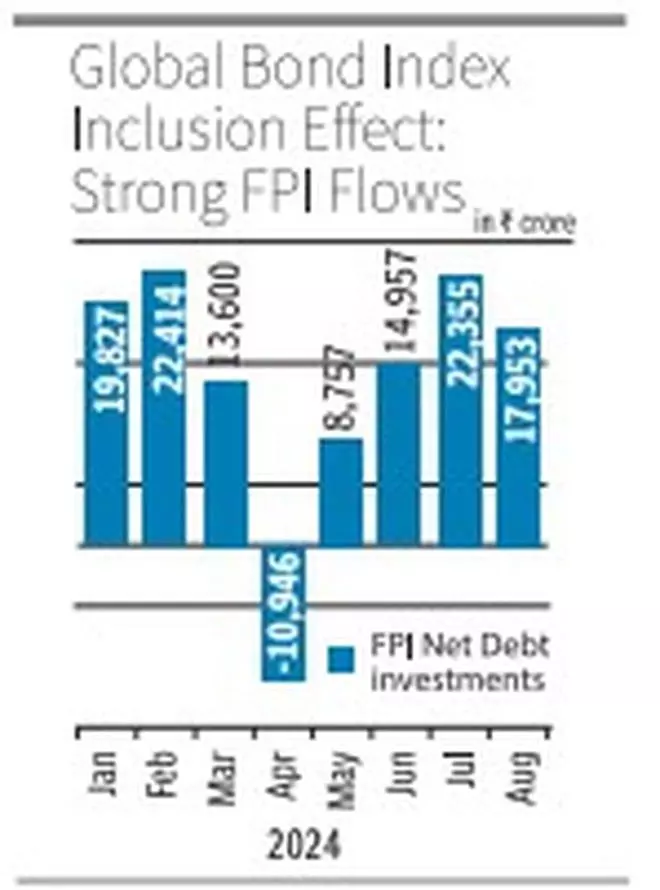

Currently, of the $18 billion that FPIs have invested in Indian government bonds since the index inclusion announcement, $12.9 billion has been invested between October 2023 and June 2024. From the index inclusion date of June 28 to the end of August, net FPI debt flows were $5.1 billion.

“FPI debt flows are also likely to remain positive given the country’s strong fiscal balance, efforts towards improved fiscal consolidation and a stable political system leading to growth stability, with an expected sovereign rating upgrade,” said Anita Rangan, economist at Equirus.

“After a steady outflow since 2018, the latest inflows are the highest ever. For the first time in over five years, debt FPI inflows have bounced back steadily in a positive direction,” she added.

Rangan also highlighted that the US Federal Reserve is likely to cut interest rates in the coming days, which along with the prospect of a rating upgrade will further increase FPI debt inflows into India.

Meanwhile, bond market experts stressed that global investors tend to take advantage of positive movements in (government) yields ahead of actual events.

Following the index inclusion announcement, India’s 10-year government bond yield rose 25 basis points, from 7.25% to 7% by June 2024. It then rose further to 6.85% by September 2024, a 40 basis point increase.

Mahendra Jaju, chief investment officer, fixed income, Mirae Asset Investment Managers Ltd. (India), said India’s inclusion in global bond indexes has been an expected development so far. The trend is pretty much alive and well. It’s sidelined for now due to temporary factors, but will pick up in due course, he added.

The overall story has been “hijacked” in a way by new hot issues like interest rate cuts by global central banks and domestic banks competing for deposits. This (the inclusion of Indian government bonds) has become a side issue for now, he noted.

“The long-term outlook for bond inclusion remains broadly intact, but structural changes will create temporary hiccups. Policy will need to be reassessed and adjusted as experience is gained,” Jajoo said.

“This (Indian bond inclusion) is no longer a front-line story but has become a side story. What could have been a very big event has become muted due to contingent factors. Had bigger index players not quickly adopted this and the FAR rules not been adjusted, the bond inclusion story would have been much more prominent.”

Focus on the Federal Reserve

On an optimistic note, Jajoo said FPI flows would continue to improve on the back of India’s strength once the US Federal Reserve’s expected rate cut this month goes ahead.

“Inclusion in the Indian bond index has encouraged international portfolio investors to look at and invest in the Indian market. Despite inclusion in the bond index, we believe FPIs have and will continue to invest in eligible Indian bonds given the revaluation of the Indian economy. This inclusion has only accelerated this trend,” said Shantanu Bhargava, Managing Director and Head of Exchange Listed Investments at Waterfield Advisors.

He said the interest rate cut by the US Federal Reserve is likely to benefit emerging markets overall in terms of capital outflows from the US as US Treasury yields will fall. “India is well positioned among emerging markets to attract more capital inflows. At the moment there are several options in the emerging markets space that are as well positioned as India,” Bhargava added.